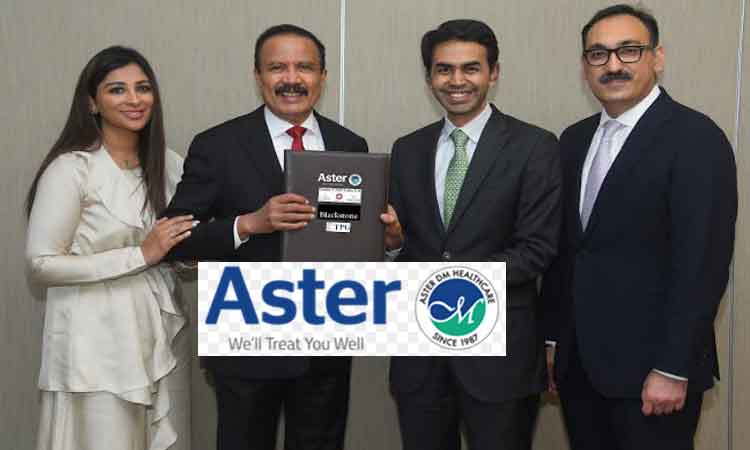

Dailymiorror.News,Bengaluru, December 1st, 2024: Aster DM Healthcare Limited (“Aster”), a leading integrated healthcare provider in India, and Quality Care India Limited (“QCIL”), a prominent hospital chain backed by Blackstone and TPG, have signed definitive agreements for a merger.

This merger, subject to regulatory approvals, will create one of the largest healthcare players in the country. Upon completion, the merged entity will be known as Aster DM Quality Care Limited.

The merger will result in a combined network of 38 hospitals, with over 10,150 beds spread across 27 cities, making it one of the top three hospital chains in India. The merger brings together four leading brands: Aster DM, CARE Hospitals, KIMSHEALTH, and Evercare.

- Scale and Reach: The combined entity will become one of India’s top 3 hospital chains by both revenue and the number of beds, with a strong presence in South and Central India.

- Enhanced Financials: The merger is expected to strengthen financial and operational metrics, delivering superior margins and returns.

- Accretive to EPS: The merger is projected to be accretive to Earnings Per Share (EPS).

- Diversification: The merged entity will have a well-diversified presence across nine Indian states, with minimal overlap in hospital locations. It will also expand into a comprehensive ecosystem, including labs, clinics, and pharmacies.

- Synergies: The merger is expected to generate significant synergies, including revenue growth, procurement and supply chain efficiencies, and integration of corporate functions.

- Growth Opportunities: The combined platform has vast growth potential with both brownfield and greenfield expansions, with an expected addition of around 3,500 new beds between FY24 and FY27.

- Backed by Leading Investors: Blackstone and TPG, two of the world’s largest private equity firms, bring substantial expertise in scaling businesses and have backed numerous successful public market companies in India.

Dr. Azad Moopen, Founder and Chairman of Aster DM Healthcare, commented: “The merger of Aster and Quality Care will create one of India’s leading healthcare organizations, bringing new standards in patient care and innovation.

Our decades of leadership in GCC and India, combined with the operational strength of Quality Care and support from Blackstone and TPG, will position us for sustained growth.

The merger will enhance our capabilities to provide world-class healthcare services and improve patient outcomes.”

Amit Dixit, Head of Asia for Blackstone Private Equity, stated: “We are excited to build one of India’s leading healthcare platforms through this partnership. Our scale, operational expertise, and life sciences insights will be key drivers of success as we expand and enhance this business.

We look forward to working with the Moopen family and believe Varun Khanna is the ideal leader for the combined entity.”

Alisha Moopen, Deputy Managing Director of Aster DM Healthcare, added: “Through this strategic merger, Aster and Quality Care are joining forces to raise the bar in healthcare excellence. We are committed to enhancing patient outcomes and providing high-quality services across India.”

Ganesh Mani, Senior Managing Director at Blackstone, shared: “Blackstone’s focus on life sciences globally has led us to support Quality Care’s expansion. By partnering with Aster, we are creating a healthcare powerhouse with an emphasis on patient care, innovation, and infrastructure development.”

Vishal Bali, Senior Advisor at TPG, said: “We are thrilled to see Quality Care join forces with Aster to create one of India’s top multi-specialty hospital chains. TPG’s long-term focus on healthcare excellence is aligned with this merger’s goal of improving patient safety and clinical outcomes.”

Varun Khanna, Group Managing Director of Quality Care, concluded: “This merger reflects our shared vision and commitment to improving access to quality healthcare across India. We are excited to take this platform forward and continue serving communities with excellence.”

Aster is valued at a multiple of 36.6x on FY24 adjusted post-IND AS EV/EBITDA, while QCIL is valued at 25.2x based on the same metric. As per the valuation report, the shareholding structure of the merged entity will consist of 24% held by Aster promoters, 30.7% by Blackstone, with the remaining 45.3% held by the public and other shareholders.

Before the merger, Aster will acquire a 5% stake in QCIL from Blackstone and TPG, and the two entities will then merge by way of a scheme of amalgamation. The transaction is expected to close by Q3 FY26, subject to shareholder and regulatory approvals.

- Dr. Azad Moopen will continue as Executive Chairman of the merged entity.

- Varun Khanna will be promoted to Managing Director & Group CEO.

- Sunil Kumar will serve as Group CFO.

Moelis & Company and Advay Capital are financial advisors, while Kotak Investment Banking is the corporate advisor. Cyril Amarchand Mangaldas is legal counsel to Aster, and NovaaOne Capital has acted as financial advisor to QCIL.

This landmark merger is poised to create a transformative force in the Indian healthcare sector, setting new benchmarks for patient care, accessibility, and operational excellence.